Marijuana Industry Analysis

May 28, 2019

Presented by Jake Rivas, CFP®

Industry overview

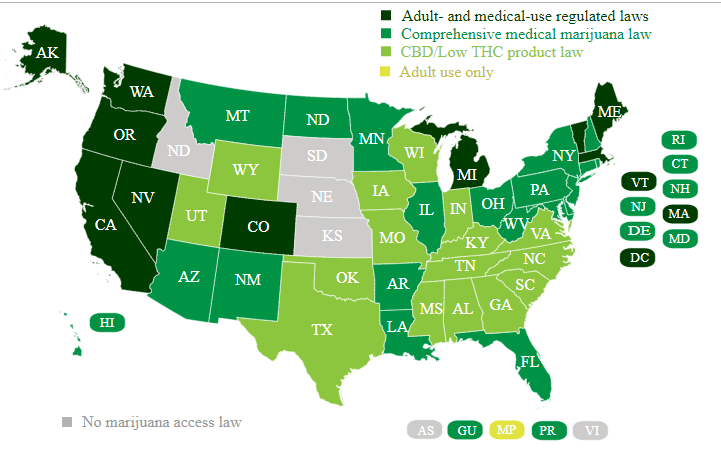

The marijuana industry has come into the limelight over the past several years, with many states in the U.S. legalizing it for recreational use, including California, Maine, Massachusetts, and Nevada. Most of the U.S. now allows for the use of medical marijuana, including cannabinoids (more commonly known as CBDs). Canada officially approved the use of recreational marijuana on October 17, 2018, which further increases overall demand in North America.

Although there have been many changes in state policies surrounding marijuana, it should be known that there is a difference in regulation for pharmaceutical companies developing cannabis-based treatments. Under federal law, cannabis is still considered a Schedule I drug, meaning that it is currently not accepted for medical treatment. This means that the legalization of marijuana across new states has little impact on the success of any company developing marijuana-based products for medicine. As we have seen in recent months (e.g., with the epilepsy drug Epidolex), after U.S. Food & Drug Administration approval, the U.S. Drug Enforcement Administration must determine whether a marijuana-based treatment should be rescheduled. Aside from Epidolex, several other marijuana-based drugs are in development that provide treatments for conditions ranging from nausea to acute pain.

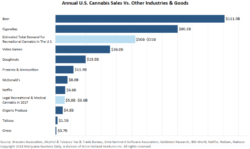

The marijuana industry is targeted by many biotechnology, beverage, and tobacco companies as an area of opportunity for growth. Based on data from BDS Analytics, it’s been estimated that marijuana-related sales will almost triple across North America, from $9 billion in 2017 to $24 billion by 2021.

Geographic shifts

Source-National Conference of State Legislatures

Source-National Conference of State Legislatures

Recently, Alaska and Michigan legalized recreational marijuana, and there have been pushes for most other states to follow suit. The only states that do not allow for any marijuana use are Idaho, Nebraska, and South Dakota. Kansas recently approved the medical use of CBD products, and Nebraska has decriminalized the drug. Connecticut, Illinois, Minnesota, New Hampshire, New Jersey, New Mexico, and New York, among others, are projected to have marijuana legalized for recreational use in 2019. This all shows the rapid expansion of the marijuana industry across the U.S., which should lead to an increase in potential sales.

Industry growth

An interesting chart (below) from the Brewers Association shows the potential demand for cannabis relative to other consumer discretionary industries. This rather optimistic projection is likely one reason alcohol and tobacco companies are now actively seeking partnerships, mergers, and acquisitions within the cannabis space. As one example of the potential synergies between the two, some alcohol companies are looking to infuse CBD oils into their drinks.

Tobacco companies facing a decline in demand because of public health concerns and FDA backlash are looking to become the next face of mass marijuana distribution. If the demand scenarios are accurate, marijuana has the potential to become one of the next legs of growth across the consumer discretionary industry.

The passive flows from ETFs are causing capital appreciation across the industry, as thematic investors attempt to capitalize on the opportunities in this area. Larger marijuana companies have increasingly gained momentum as the top weights in these thematic ETFs. This passive capital infusion is helping to fuel the growth of marijuana companies while creating inefficient market values. It should be noted that most publicly traded marijuana companies are trading at significant premiums based on future expectations for significant revenue growth.

Investment risks

Politics play a large role in the risk of these investments, but around the globe, cannabis use has become widely accepted for both medical and therapeutic use. Lawmakers have ultimately been forced to take the views of their constituents. Moreover, it has been nearly impossible to turn an eye away from the potential tax windfall from marijuana sales. One risk is that of out-of-prescription use where the product is grown, sold, and used outside of regulation. But this risk is gradually being reduced as supply becomes widely accepted and readily available.

Marijuana industry investments are highly speculative and can have large swings in value; as such, diversification is imperative. Investing in large-cap health care or consumer discretionary names with a marijuana segment can be a good way to participate in the returns with less volatility. Thematic ETFs are another way to follow the industry without taking on excessive idiosyncratic risk.

This material is intended for informational/educational purposes only and should not be construed as investment advice, a solicitation, or a recommendation to buy or sell any security or investment product. Certain sections of this article contain forward-looking statements that are based on reasonable expectations, estimates, projections, and assumptions. These statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Investments are subject to risk, including the loss of principal. Please contact your financial professional for more information specific to your situation.

Exchange-traded funds (ETFs) are subject to market volatility, including the risks of their underlying investments. They are not individually redeemable from the fund and are bought and sold at the current market price, which may be above or below their net asset value.

Jake Rivas is a financial advisor located at i*financial, 1901 NW Military Hwy Ste. 102, SA, TX 78213.

He offers advisory services as an Investment Adviser Representative of Commonwealth Financial Network®, a Registered Investment Adviser. He can be reached at 210-342-4346 or at jake@youandifinancial.com.

Authored by the Investment Research team at Commonwealth Financial Network®.

© 2019 Commonwealth Financial Network®